Our new rating scale explained

This view was previously expressed through a 7-point scale ranging from ‘low likelihood’ to ‘high likelihood’. As of today, this has been updated to a new 8-point scale, ranging from ‘highest likelihood’ to ‘lowest likelihood’.

This article outlines the changes involved and provides details on the updated scale. The changes are also summarised in the following explainer video:

What is the BeZero Carbon Rating (BCR) and rating scale?

The BCR expresses our opinion that a given carbon credit represents one tonne of CO₂e avoided or removed. Making this assessment requires analysing the risks a project is exposed to and how they impact the carbon efficacy of the credits issued. The full details of how the BCR assessment is conducted can be found in the BCR methodology document.

The multi stage process of assessing a credit’s carbon efficacy culminates in an analytical view of the likelihood it achieves a tonne of carbon avoided and/or removed. This view is expressed through the rating definition, i.e. the range of likelihoods assigned, and reflected in the rating scale.

Previous rating scale

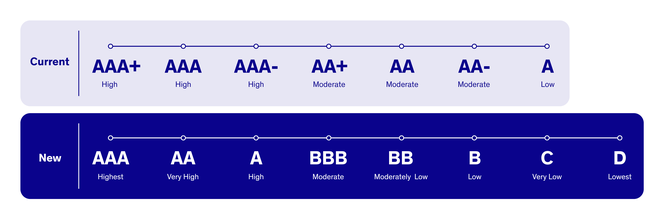

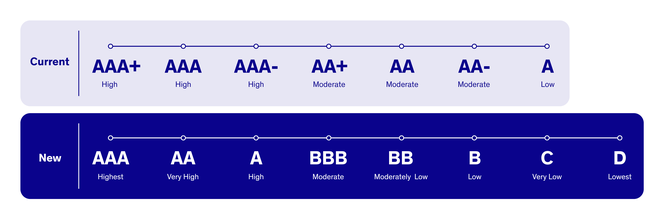

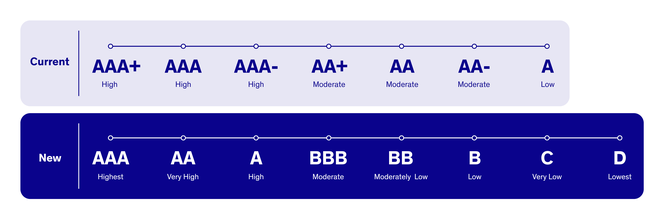

Previously, the BCR definition ranged from ‘low’ to ‘high’ and was reflected by a 7-point scale ranging from A to AAA+ (see table below).

New rating scale

The BCR scale has been updated to an 8-point scale ranging from ‘highest’ to ‘lowest’ likelihood. The change involved two parts:

a literal translation of the previous 7-point rating scale to the first 7 points on the new scale and,

the addition of a new point at the lowest end of the scale

The updated scale along with a comparison with the previous scale is presented in the diagram below:

Rationale for the change

The change was driven by market feedback, including but not limited to:

A traditional financial market rating scale is more intuitive and easier to understand.

Letter-specific risk definitions are more precise and clearer than three risk buckets.

Directly comparable rating scales reduce market confusion.

Implications of the change

There are no analytical implications of this change on any outstanding ratings.

All projects with outstanding ratings as of today have been translated from their old rating to the new rating.

Questions and feedback

A series of Q&As is available below. Feel free to contact us at contact@bezerocarbon.com or your account manager if you have any further questions or require any clarifications.

Q&As

Q: Can you explain what has changed?

BeZero Carbon has changed its rating scale to a 8-point scale (running from AAA to D) from the previous 7-point rating scale. The change involved two parts:

a literal translation of the previous 7-point rating scale to the first 7 points on the new scale.

the addition of a new point at the lowest end of the scale.

This change is illustrated in the following table:

| Current rating scale | AAA+ | AAA | AAA- | AA+ | AA | AA- | A | - |

|---|---|---|---|---|---|---|---|---|

| New rating scale | AAA | AA | A | BBB | BB | B | C | D |

Q: Are there any changes to the ratings definitions?

Yes. The rating definitions have been modified to better express the underlying granularity of the risk assessment, associated with the rating scale.

Previously, the 7-point scale only had three ‘definitions’ - ‘high’, ‘moderate’ and ‘low’, which we and our users found insufficient to fully understand the underlying risks. We have therefore updated the definitions to 8 distinct risk descriptors, corresponding to the new 8-point scale. This is illustrated in the diagram below:

Q: Why has BeZero Carbon changed its rating scale?

The decision to change our scale is a response to extensive user consultation and stakeholder engagement across the full carbon market value chain. Their feedback included, but was not limited to:

A traditional financial market rating scale is more intuitive and familiar.

Carbon ratings in general lack clear definitions of what grades mean; and transitioning to letter-specific risk definitions would be more precise than the three risk buckets BeZero was using up until now.

Directly comparable rating scales reduce market confusion.

We feel the shift outlined above satisfies this feedback and is consistent with our ambition of helping carbon market participants make better decisions.

Q: Why now?

The BeZero Carbon Markets platform launched in April 2022 and the ratings have since become the most widely adopted ratings in the market via our partnerships. We have also had more than 2,000 individuals from hundreds of organisations sign up to view our free headline letter ratings and ratings summaries on our website.

Despite being fairly well entrenched, that period also gave the team enough time to listen to the market and better understand what market participants wanted from a scale: comparability, clarity, and clear definitions. We feel enacting this change as we approach our first full year of trading strikes a fair balance between giving the concept of a rating time to bed in while still being new enough to allow the new scale to settle.

Q: Does the new ‘D’ rating imply that the project has ‘failed’?

No.

The introduction of a ‘D’ rating as our lowest point does not imply that a credit, or the project it is issued by, has failed. Projects given this rating are in our view the least likely to deliver on their core carbon claim in comparison to all other rated projects with higher ratings.

We believe it is the role of Standards Bodies to formally classify a project as ‘failed’.

Q: Have any of the ratings changed?

No.

The existing ratings have been translated onto the corresponding new scale on a one-to-one basis as outlined in the diagram above.

Q: The new scale has expanded the ‘rating definitions’. Are there any implications of this as a user?

No.

The decision to expand the risk definitions and add more granularity is in direct response to feedback that three risk buckets was too broad for the full market coverage being offered. The new scale adds precision rather than having discrete new analytical implications.

Q: Previously, credits rated ‘AA-’ were defined to have ‘moderate’ likelihood of delivering on 1tCO₂ e. The new rating scale defines them to have ‘low’ likelihood of delivering on 1tCO₂ e. Similarly, credits previously rated as ‘A’ were defined to have ‘low likelihood’; the new rating scale defines them to have ‘very low likelihood’. Have these ratings been downgraded?

No.

The updated definitions do not represent any downgrade (or upgrade) of our ratings. The ratings scale represents a more precise relative gradation of risk.

All existing ratings have been mapped one-to-one onto the new scale with no change to their relative position on the risk spectrum. The new scale provides a much more granular description of the associated risks at each ratings level which would be very helpful to market participants.

Q: We have already created and circulated sales/marketing collateral using your ratings. Do you need to make this change?

Yes.

The consensus market feedback strongly indicated that this is an important change to reduce confusion, boost comparability, and accelerate the adoption of ratings in the carbon market.

We apologise for any inconvenience but all prior ratings will no longer be valid as of the Effective Date of 13 March 2023. We appreciate this may require some additional effort at your end. If there is anything we can do to support your transition internally or with clients, please let us know.

Q: Your ratings are being displayed on our platform. Do you really have to make this change?

Yes.

The consensus market feedback strongly indicated that this is an important change to reduce confusion, boost comparability, and accelerate the adoption of ratings in the carbon market.

We apologise for any inconvenience but all prior ratings will no longer be valid as of the Effective Date of 13 March 2023. We appreciate this may require some additional effort at your end and our tech team has created relevant guidance documents and built a new sandbox environment to support testing for this transition.

If there is anything we can do to support your transition, please let us know.

Q: What can we do if we are unable to implement any of the changes on our platform?

We apologise for any inconvenience caused by this change.

However, as per our terms of use, the BeZero Carbon Rating must be accurately and consistently displayed on all third party platforms at all times.

In the event this is not deliverable, we will endeavour to support your team in transitioning to the new scale or, regrettably, insist BeZero’s information be removed until it is displayed as requested.

Q. Will BeZero be updating all existing criteria, methodology and research reports which allude to the previous rating scale?

Yes and no.

BeZero has made available extensive documentation on its criteria, methodology, analytical thought process and published a number of research papers and insights, all with a view to enhance the transparency in the Voluntary Carbon Market and to educate market participants.

All criteria and methodology documents are live. Any reference to the previous ratings scale, ratings definitions or headline letter ratings will be updated to reflect the new ratings scale. This includes the ratings scale, definitions, criteria and methodology documents, ratings summaries, ratings reports, primers, ratings briefs etc.

All our publications are time stamped and will remain unchanged. Rather than changing all documents and references to ratings, we have added a clear and obvious disclaimer alerting the reader to relevant material explaining the rating scale change.

Q. Is there a risk that someone continues to market a project that’s currently rated ‘A’ under the new scale which would misrepresent the rating (making it appear to be previously ‘AAA-’)?

Yes.

To reduce the possibility of such mis-use, in the context of the change in rating scale, we have implemented an extensive communication plan which inter-alia, includes:

Advance notification to all our current and potential users explaining the proposed change and answering their questions.

Updating all ratings on our website, where all our headline letter ratings and ratings summaries are freely accessible to the public

Issuing a wider media release to publicise the change

Publishing this explainer blog and detailed Q&As explaining the change.

Producing a short explainer video explaining the change.

While we will make all efforts to ensure our commercial partners comply with our terms of use, old or stale references to BeZero Carbon Ratings may persist, malicious or otherwise.

All our ratings are freely available on our website and we actively encourage all market participants to use this resource to confirm the ratings are live and accurate when referenced in non-BeZero materials.

In case anyone is aware of any mis-use or mis-representation of our ratings, please contact legal@bezerocarbon.com immediately.

Q. Have you also updated the risk factor scale to be in line with the ratings definitions?

No.

We have not made any changes to the risk factors or to our risk factor assessment process.

BeZero continuously reviews and updates its analytical framework and as and when we believe there is a need and value in changing the risk factors or risk assessment process, we will inform the market accordingly.