Ratings in compliance markets

Independence, strategic insight and collaboration to scale carbon markets with integrity.

Market-building research

Explore our market design and policy reports

Market design

Article 6

Geographical deep dives

Shaping the frontier of carbon markets

Market-building research

From Article 6 to CORSIA, through to compliance schemes and VCM regulation, our work explores and shapes the frontiers of carbon market policy

Regulation setting agenda

Our research and data helps governments interpret and apply regulatory frameworks to domestic and regional policy

Government engagement

Supporting evidence-based policy design through collaboration and capacity building

Ratings in any market

Supporting governments and multilateral organisations with carbon ratings and risk assessments for high integrity markets

Meet the team

Joel Gould

Markets & Policy Lead

Lily Ginsberg-Keig

Senior Manager, Policy and Government Engagement

Isobel Sizer

Policy Associate

Finn O'Muircheartaigh

General Manager, APAC

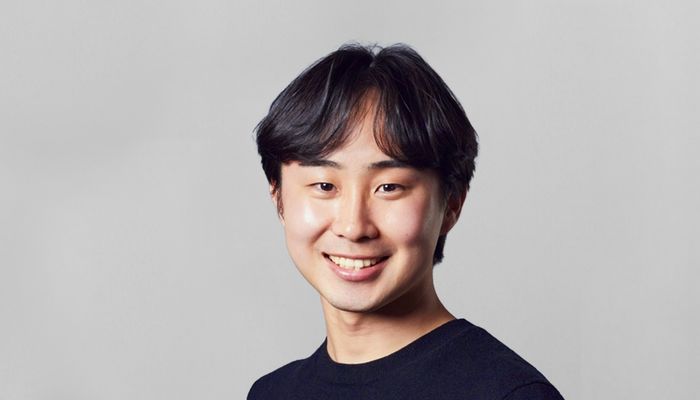

Kenshiro Kawasaki

Commercial Research Analyst

Events

Webinar - Building viable carbon projects in Africa: Thursday 19 February, 09:30 GMT/12:30 EAT. Hear from special guests at GIZ, Standard Bank, BURN, and Mandulis Energy as they share insights on Africa’s carbon market landscape.

Explore our webinars

See moreWebinar - Carbon markets: 2025 insights, 2026 outlook

Insights from our 2025 carbon credit market review, plus expert perspectives on emerging trends, policy developments and the year ahead.

Webinar - The EU's 2040 target: Can carbon credits deliver cost efficiency and climate impact?

Watch our panel on carbon credits, policy debates & how to cut costs while maximising climate impact