Project Fundamentals in action: example use cases

Key takeaways

BeZero’s Project Fundamentals equip carbon market actors with standardised and digitised technical project data, reducing data extraction time from hours to seconds.

From project developers and investors, to carbon advisors and end buyers, robust fundamental datasets are essential for anyone involved in project design, due diligence, and carbon market research.

Built and defined by BeZero’s data scientists and sector experts, Project Fundamentals deliver instant access to technical information, freeing internal resources, reducing reliance on external dependencies, and enabling evidence-based decision-making.

Contents

- Technical data extraction: from hours to seconds

- Developer preparing forestry project design documentation for a standards body and VVB

- Environmental consultant advising a project developer on effective cookstove programme implementation

- Energy giant conducting a feasibility study for new hydropower projects in Central Africa

- Carbon portfolio manager screening high-quality forestry projects for a sophisticated investor

- Government official developing a procurement strategy for Article 6.2

- Sustainability manager performing forestry credit due diligence for internal offsetting purposes

- Technical carbon project data, on and off BeZero’s platform

- The backbone of carbon project analysis

Just as stock market analysts rely on financial statements to glean critical information about a company’s health, carbon market participants can unpack what’s underpinning performance and risks in a carbon project by analysing its underlying fundamentals.

With the launch of Project Fundamentals, BeZero has introduced a market-first innovation, helping stakeholders across the carbon value chain find and assess technical and operational parameters for carbon projects of all types.

BeZero’s Project Fundamentals equips market actors with robust, digitised, and analysis-ready datasets to help them evidence their decision making. Whether for project origination and design, due diligence and assessment, or market research and benchmarking, the use cases are endless.

Technical data extraction: from hours to seconds

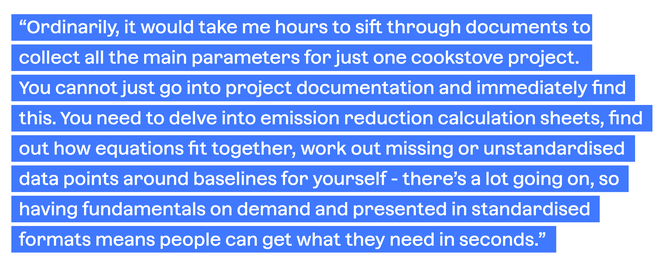

The time saved from having fundamental datasets on demand is transformative. In the words of one of BeZero’s carbon ratings analysts, who themselves use a subset of this data to inform ratings assessments:

To illustrate how BeZero’s Project Fundamentals can reduce friction in project analysis and decision making, we have put together a range of hypothetical scenarios and use cases showing fundamentals in action.

Let’s start with three illustrative scenarios for using fundamental data in project design and origination.

Developer preparing forestry project design documentation for a standards body and VVB

Challenge

An avoided deforestation project developer in Southeast Asia is preparing documentation for submission to a standards body and a Validation & Verification Body (VVB). To secure accreditation and credit listing, they require a robust Project Design Document that goes above and beyond the minimum requirements of the methodology.

Solution

The developer turns to BeZero’s Project Fundamentals to download detailed information about similar projects in the region, with both high and low BeZero Carbon Ratings. They use this data to find clues and patterns for what “good” and “bad” looks like in the secondary ex post credit market.

They notice for instance variation in BeZero’s assessment of permanence for a handful of projects, even though they follow the same methodology. Data on forest loss offer useful insights here, particularly in a fire-prone region such as this one. For instance, they filter projects by loss events to see which ones might be at greater risk based on their history of reversals. Digging deeper into the numbers allows them to quantify the scale of historic loss in terms of emissions and surface area, helping contextualise their significance. They note that projects with a greater than minimum 10% deposit in the risk buffer contribution tend to rate higher for permanence risk - a useful input for conservative project design.

Impact

From choosing a representative baseline, to mitigating potential reversals effectively, this wealth of technical information in analysis-ready formats made it easy to identify conservative approaches and figures tailored to the local context of the developer’s planned project.

The project gets validated and listed on the registry, generating instant demand because its conservative claims on expected carbon efficacy are substantiated by transparent, hard data.

Environmental consultant advising a project developer on effective cookstove programme implementation

Challenge

An environmental consultant is helping a project developer in East Africa choose a robust cookstove methodology, design and roll out devices effectively, and raise private capital. They have been manually sifting through hundreds of project documents in order to understand what “good” project design looks like, but they aren’t deep sector experts, and the lack of standardised information across registries makes it a cumbersome and time-consuming process.

Solution

To accelerate their research, the consultant turns to BeZero’s Project Fundamentals on the cookstoves sub-sector. They know one of the key determinants of accurate issuance calculations relates to fNRB (fraction of non-renewable biomass) values, which refer to the proportion of woody biomass in the project region being harvested unsustainably. To lower the risk of over-crediting, they use BeZero’s datasets to instantly identify projects with more conservative fNRB values than those of global datasets.

From there, they hone their analysis further based on other key parameters linked to emissions reduction calculations, including baseline fuel consumption, thermal efficiency, and fuel savings. Leveraging BeZero’s analysis of rated cookstove projects, they then identify value ranges typically associated with lower carbon accounting risk. This combined information sets a useful benchmark for carbon quality.

Impact

The developer reports this intelligence as a “game changer”. They’ve saved time trying to figure out best practices for project design and implementation, demonstrated how to de-risk the investment by applying conservative carbon accounting, and assured future credit buyers they’ll be able to make credible claims about their climate impact.

Energy giant conducting a feasibility study for new hydropower projects in Central Africa

Challenge

A leading supplier of both fossil fuels and renewables has committed to an ambitious energy transition plan. They are exploring opportunities in carbon markets to help finance their transition, and potentially make investments in hydropower. Any projects they commission must accurately account for carbon emissions and savings.

Solution

To better understand the market, the team downloads BeZero’s fundamentals for all existing hydropower projects in the region. They are particularly interested in understanding what’s driven credit issuance over time within their chosen peer group.

They look at net grid exports - the amount of electricity a project exports to the grid that displaces energy production elsewhere. In some instances, this parameter helps them interrogate specific peaks and troughs. The team finds for instance that an issuance slump in a specific year could be linked to a drought during which some projects generated less electricity.

Another useful parameter is the project combined margin emission factor (EFCM), which is used to convert units of exported electricity to emission reductions. The team can use this alongside net grid exports to work out credit issuance. They observe that projects that use static and/or unrealistic EFCM values tend to exhibit higher over-crediting risk, according to BeZero’s ratings analysis. Dynamic values tend to minimise this risk, because they take into account more energy being added to the grid over time.

Impact

The ability to unpack specific drivers of credit issuance at a project-level allowed the team to conduct a thorough market analysis by uncovering the mechanics and local intricacies of these project types. Furthermore, access to BeZero’s risk analysis enabled them to connect the dots between higher rated projects, and the fundamental parameters contributing to quality.

With a solid estimate of the amount of carbon credits the planned hydro projects might generate, they proceed with their origination. The insights gleaned from fundamentals also help them contribute to the projects’ design and implementation in a uniquely hands-on manner.

Now let’s see how Project Fundamentals might help carbon market participants with project due diligence and assessment.

Carbon portfolio manager screening high-quality forestry projects for a sophisticated investor

Challenge

A carbon portfolio manager for nature-based climate solutions has been selected by a high-profile investor to build a diversified portfolio of forestry credits.

The investor has a number of constraints, including a mix of avoided deforestation, improved forest management, and afforestation, reforestation and restoration projects. They are keen to invest in both pre-issuance and ex post credits, and want to diversify their exposure to the main carbon risk factors.

Solution

To truly diversify risk, the portfolio manager knows he will need to select a large number of projects. He starts by filtering credits based on the investor’s requirements using BeZero’s Project Fundamentals, instantly giving him relevant analysis-ready data.

Digging deeper into top rated projects makes it possible to extrapolate drivers of high carbon efficacy, and find unrated projects with similar attributes. For example, he screens for projects that adopt conservative time function baseline models which factor in decreases in deforestation rates over time, unlike those who predict exponential increases in deforestation, or aggressive logistical models that assume approaching 100% forest loss over the crediting period.

Another useful parameter is the amount of carbon stocks attributed to reported carbon pools. Projects that attribute the bulk of credit issuance to soil organic carbon - notoriously difficult to accurately measure - are removed from his shortlist, because he favours those that base the bulk of their issuance on aboveground biomass. He narrows his selection further by filtering out projects that have not applied discounts for leakage from activity shifting or for market leakage. He also digs deeper into REDD+ and ARR projects that include harvesting or logging, as well as the amount of wood legally harvested, because this can have a material impact on additionality.

Some projects in his final selection are unrated, so he commissions BeZero Carbon Ratings for them as an independent layer of scrutiny.

Impact

BeZero’s fundamental datasets were instrumental to his due diligence. What would have taken him weeks in data collection and analysis took mere days. Thanks to this seamless access to critical forestry parameters, he was armed with both the raw data and BeZero’s risk analysis to support his recommendations to the investor.

Government official developing a procurement strategy for Article 6.2

Challenge

A government director is looking to develop a procurement strategy for the Article 6 market. She is looking to include high-impact cookstove projects as one of the key project types in the strategy. The intention is to purchase Internationally Transferred Mitigation Outcomes (ITMOs) to meet targets set out in the country’s Nationally Determined Contributions (NDC). As the buying country for Article 6.2, the director needs to consider how to screen and select project types from the supplier country.

Solution

Collecting technical data on the parameters underpinning cookstove projects and their performance proves slow and cumbersome, with project information inconsistently reported and stored in multiple registry documents. To shortcut the process, they turn to BeZero’s decision-ready cookstove project fundamentals.

Their main goal is to find examples of high carbon efficacy in the secondary market, and deepen their understanding of the key parameters and indicators of quality for cookstove projects.

For example, they rapidly filter out projects by fuel types and thermal efficiency to focus on devices with cleaner fuels and higher efficiency. To make sure emission reductions haven’t been overstated, they look at their reported baseline thermal efficiency and fuel consumption. This immediately filters out projects with lower baseline thermal efficiencies than the most up to date default values, as well as projects with non-conservative assumptions around baseline fuel consumption.

From fNRB values and usage rates from surveys, to leakage discounts and stove-stacking adjustment factors, these kinds of technical details and nuances that go beyond the headline figures are useful inputs into the requirements and constraints they will set out in their procurement strategy.

Impact

Having pulled all this evidence together, the team presents the key considerations for, and characteristics of, cookstove projects likely to meet a high-quality threshold.

Leveraging these technical insights, the director is able to reference parameters and best practices to decide on high-quality cookstove projects in their procurement strategy. This enables her to go into Bilateral Agreement negotiations with a host country with a clear idea of the type of projects they would be looking for.

Sustainability manager performing forestry credit due diligence for internal offsetting purposes

Challenge

A sustainability manager for a major airline is responsible for the company’s approach to carbon offsetting as part of its net zero strategy.

With heightened scrutiny around carbon credit quality, and the credibility of the company’s climate claims at stake, he has to minimise reputational risk, and convince his Chief Sustainability and Chief Financial Officers that their carbon credit purchases are likely to deliver legitimate climate action.

Solution

His sustainability team has access to BeZero’s platform, which hosts project ratings, associated risk analysis, and fundamental datasets.

The manager starts by screening and shortlisting projects based on the company’s needs and preferences: CORSIA-eligible reforestation projects based in Latin America, with a commitment period duration of at least 50 years, and with a minimum BeZero Carbon Rating of ‘BB’.

While BeZero’s opinion on carbon efficacy acts as an anchoring point for quality, the manager wants to interrogate this risk analysis further and formulate his own opinion. By downloading the full suite of parameters related to forestry projects in LATAM, alongside the accompanying guidance on how to interpret them, he performs a thorough deep dive on the projects’ carbon risks, including standardised information on deforestation baselines and forest loss.

All this technical data equips him with tools to make detailed comparisons between projects, and benchmark them against the wider market.

Impact

The sustainability manager saved days’ worth of work usually spent scraping information from dozens of PDFs, and transforming that data into usable analytical formats. Instant access to these critical technical and operational parameters supercharged his due diligence process, improved his knowledge of the forestry sector, and made it easy to cross-reference fundamental data with ratings, CORSIA eligibility, and credit prices.

The ability to demonstrate his findings with verifiable data added unique weight to his recommendations to the CSO and CFO. Furthermore, the digitised datasets helped him build simplified charts, making his presentation more visual and graspable.

Technical carbon project data, on and off BeZero’s platform

BeZero’s Project Fundamentals are standardised across project types, digitised for immediate use, and decision-ready for practical application. Whether you are looking to take early-stage projects off the ground, or assess live projects in the market, fundamentals equip you with the essential building blocks for quantitative analysis, risk modelling, and benchmarking.

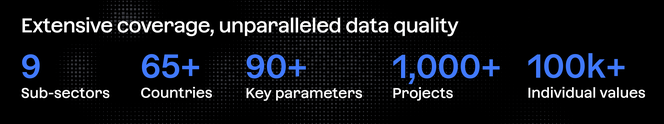

Our global team of 80+ climate and geospatial scientists collaborated with our data analysts to identify and define the critical sector-specific parameters that underpin different project types. Tens of thousands of hours were spent painstakingly collecting, cleaning and standardising this raw technical data from across 1,000+ projects.

*Data coverage available as of December 2024. New sectors and parameters will continually be added to BeZero’s fundamental datasets.

Datasets are built with extensive data quality control processes and monitoring systems, and updated whenever new information in publicly available project documentation appears on registries.

Our pre-packaged datasets are easy to navigate, and can easily plug into existing workflows and in-house models. Subscribers can access these on and off BeZero’s platform in order to dig deep into fundamentals, manipulate data, and draw their own conclusions on potential or realised project performance.

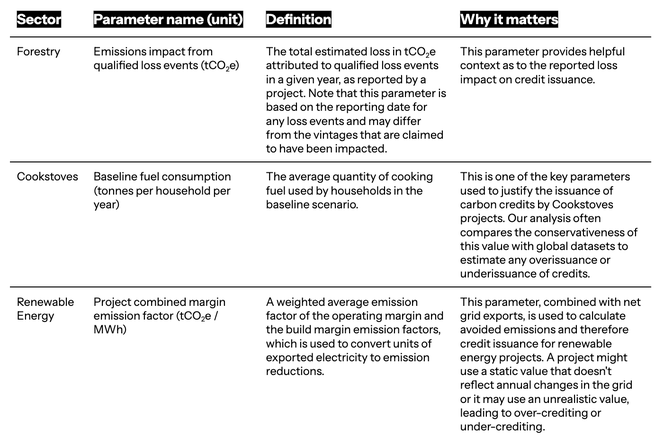

The real power of fundamental analysis lies in the combination of multiple parameters, because this unveils the wider project context, and uncovers valuable insights. To make these datasets as clear and useful as possible, users benefit from definitions and guidance on how to interpret each parameter.

Table 1. Examples of definitions and guidance for parameters in Forestry, Cookstoves and Renewable Energy sectors.

The backbone of carbon project analysis

Having access to the essential building blocks of carbon projects forms the backbone of effective project analysis. From origination to retirement, anyone in the carbon credit value chain using fundamentals to support their project development and due diligence benefits from:

Technical information made accessible: sector-specific parameters underpinning project performance that matter the most, as defined and explained by BeZero’s full-time, multidisciplinary ratings analysts.

Instant access, all in one place: access to digitised data, at scale and through time, drastically reduces time spent manually sifting through PDFs and extracting inconsistent information.

Defensible decision making: the ability to easily evidence your analysis and recommendations with robust data means nobody has to fly blind in carbon decisions and transactions.

Cost effectiveness: analysis-ready datasets brought in-house frees up internal resources and external dependencies.

If you have any questions or feedback, or would like to request a demo, please get in touch at commercial@bezerocarbon.com.

You can also watch replays of our webinars on Cookstoves and Forestry fundamentals.