Location, location, location: country-level analysis and BeZero’s framework

Here are some key takeaways

Country-level analysis is an essential part of the BeZero Carbon Rating.

How environmental laws and targets are enforced can have a bearing on various risk factors, including additionality and policy.

Whether a project takes, or does not take, specific safeguards to counter country-level risks is a key consideration to our assessments.

Contents

- Additionality

- Over-crediting and national data

- Leakage: domestic and cross-border

- Permanence and place

- Making sense of a project’s policy environment

- What if a project has no country?

- Conclusion

Please note that the content of this insight may contain references to our previous rating scale and associated rating definitions. You can find details of our updated rating scale, effective since March 13th 2023, here.

Introduction

Performing country-specific analysis is crucial to assigning an overall project rating. The likelihood of a carbon project achieving a tonne of CO₂e avoided or removed can be heavily influenced by the integrity of national datasets and the efficacy of country-wide legislation. Further, in order to ensure a comprehensive assessment of a project’s performance, we also consider regional trends and project-local data in our analysis.

The BeZero Carbon Rating is based on six carbon risk factors: Additionality, Over-Crediting, Leakage, Non-Permanence, Policy and Perverse Incentives, which have been explored in depth in our recent series of insights. This article will expand on that work by demonstrating how our analysis of country-specific considerations can be used to inform each of these risk factors, with notable focus on policy, within which country-level data is of particular importance.

Additionality

To illustrate country-specific assessment in action through the lens of additionality, we’ll explore an example of BeZero’s bespoke national and subnational analysis in more detail:

Electrification rates in the Democratic Republic of Congo

To inform our assessment of additionality for an off-grid renewable energy project in the Democratic Republic of Congo, we evaluate common-practice through national indicators of access to electricity.

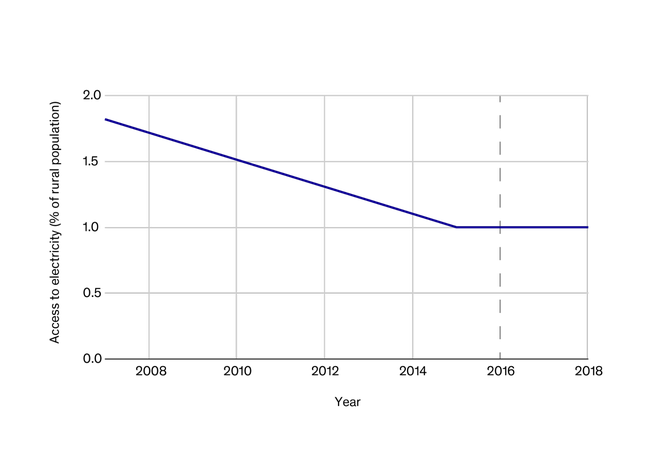

We observe that projects in the country, particularly those in rural locations, tend to be associated with a high degree of additionality because although access to electricity has been increasing (but still below 20% nationally), rural access has never exceeded 2% (see Chart 1). This indicates a lack of common practice and supports the presence of barriers to renewable energy deployment. This contrasts with most renewable energy projects in developing countries, which often exhibit high additionality risk due to established common practice and negligible need for carbon finance.

Chart 1. Understanding the penetration of technologies such as access to electricity is an example of BeZero’s country and subnational analyses forming a part of our top-down assessment. For reference, the project start year in this example was 2016.

By evaluating a country’s regulatory environment, common practice of project activity, extent of development and specific economy, we are able to make sure that national specificities underpin our view of a project’s additionality and situate it firmly in its specific region. This can also allow us to later view sub-sectors through a country-specific lens, seeing how additionality varies from place to place for certain project types and if any trends can be identified that may inform future sector-level work (Table 1).

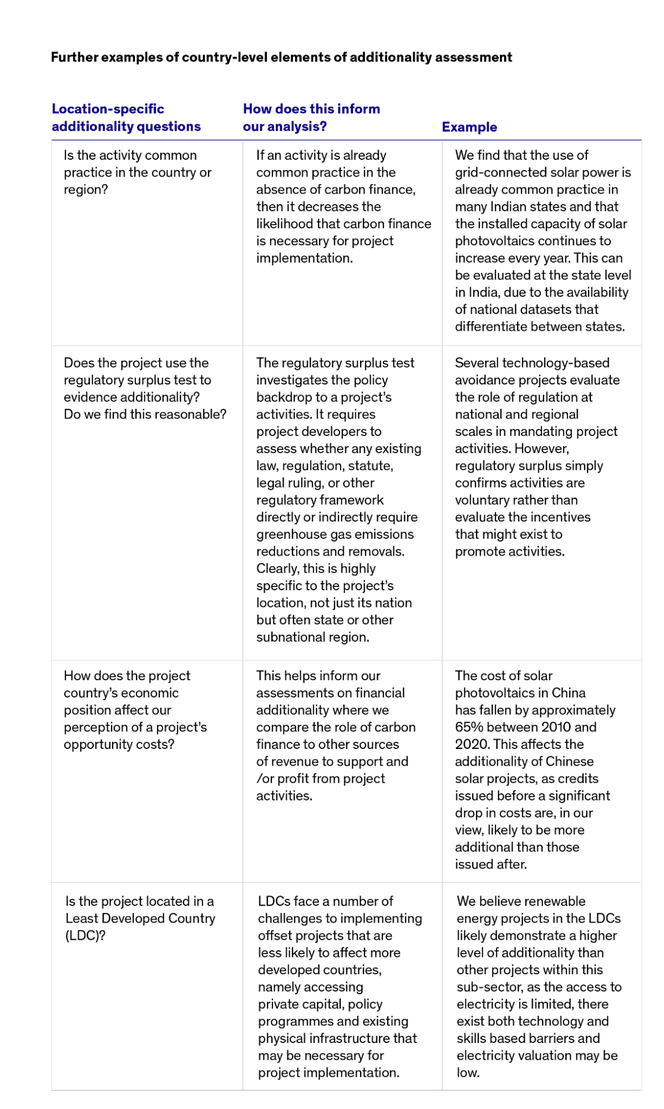

Table 1. An example of some of the key questions related to country-specific analysis of our additionality risk factor. Note that this list is not exhaustive.

Over-crediting and national data

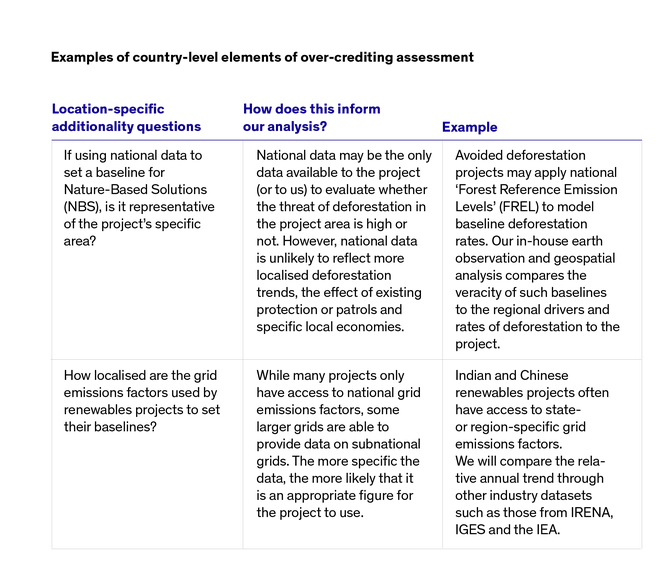

Compared to several of our other risk factors, over-crediting may typically have fewer country-specific considerations. However, the inputs that underlie a project’s carbon accounting are often sourced from national datasets or reflect national-level analysis, and this must be evaluated in the context of the specific project (Table 2).

Table 2. An example of some of the key questions related to country-specific analysis of our over-crediting risk factor. Note that this list is not exhaustive.

Leakage: domestic and cross-border

Leakage can comprise both market leakage and activity displacement, and both can have national and global implications. By considering the risk that activity is displaced to another state or region in the project country, or across an international border if relevant, we can evaluate a project’s leakage risk more effectively. The same is true for market leakage, which can have both domestic and international effects, and must be examined through the lens of that specific country’s key industries and economic priorities.

To illustrate country-specific analysis in action in informing leakage assessments, we’ll explore an example of BeZero’s bespoke national and subnational analysis in more detail:

Tobacco market effects in Zimbabwe

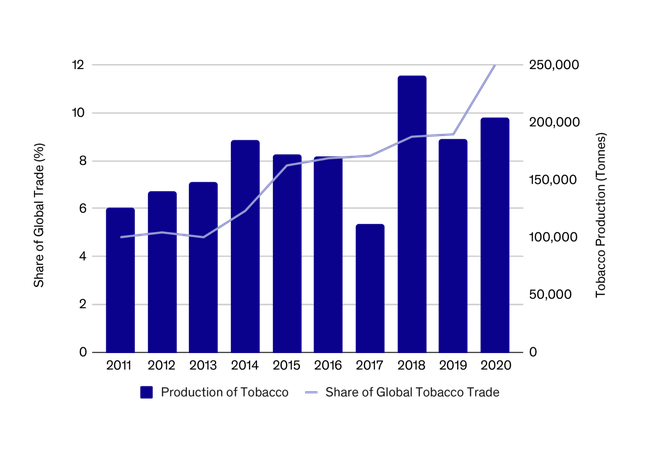

To inform our assessment of leakage for an avoided deforestation project in Zimbabwe, we evaluate market leakage through both national and international measures of the tobacco industry.

Zimbabwe is one of the largest producers of flue-cured tobacco in the world, yet this production requires considerable volumes of wood and is cited to be a primary driver of deforestation. Production is therefore banned within the project area, despite this region previously being a major source of production in the country.

We observe that since the project start date, both the production of tobacco and share of the global trade have increased within Zimbabwe. This indicates a leakage risk as it could be that production and associated deforestation have merely intensified and expanded outside of the project area as a result of the ban.

Chart 2. Understanding the market impacts of forestry projects, such as the effects on tobacco production, is an example of BeZero’s country and subnational analyses forming a part of our bottom-up assessment.

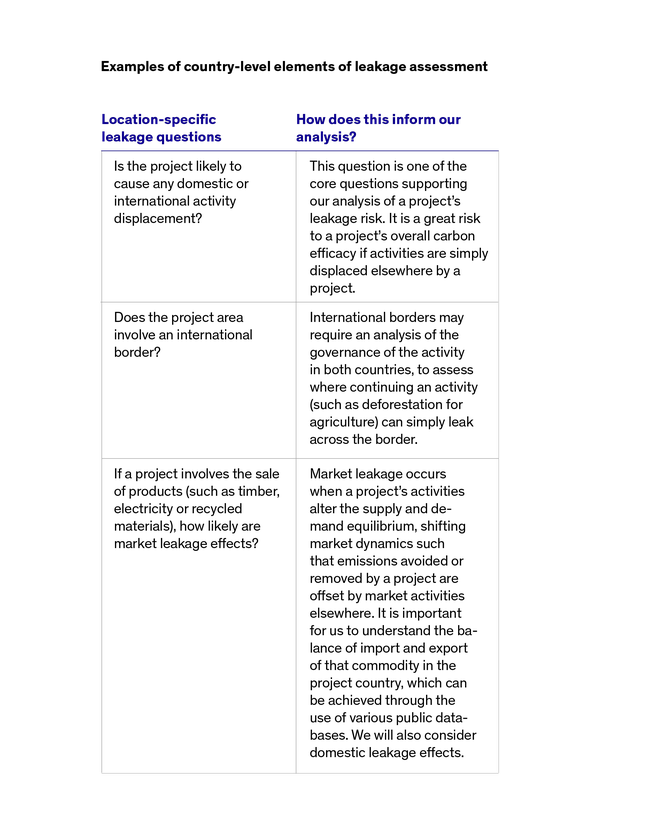

Table 3. An example of some of the key questions related to country-specific analysis of our leakage risk factor. Note that this list is not exhaustive.

Permanence and place

For NBS projects in particular, permanence has a highly location-specific component. Ecosystems are obviously embedded in their particular geographic position and so natural risks must be considered through that lens, both the risk that exists now and how that risk is likely to change over the coming decades. We may also consider the strength of a project country’s property rights, using the World Bank Property Rights Score as a proxy. This is particularly useful when ongoing land tenure is required for project implementation.

To illustrate country-specific analysis in action in informing non-permanence assessments, we’ll explore an example of BeZero’s bespoke national analysis in more detail:

Drought risks in Mongolia

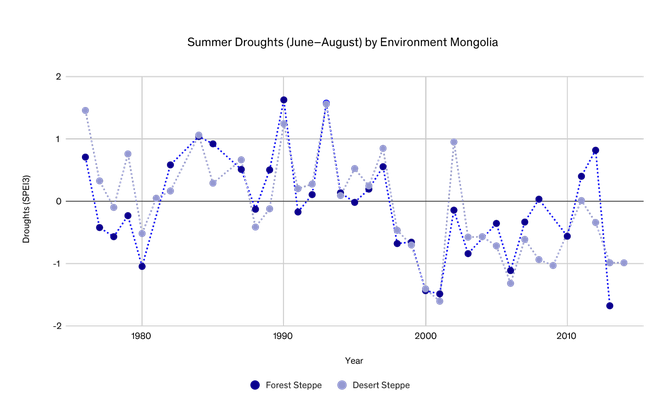

To inform our assessment of non-permanence for an avoided grassland degradation project in Mongolia, we evaluate drought risks through the Standardised Precipitation Evapotranspiration Index.

This index quantifies the degree of drought; hazardous conditions are defined as the index being lower than −1.

For both forest and desert steppe systems relevant to the region, we find that in the decades preceding the project, hazardous drought conditions have been increasing and should form a core part of the project’s risk buffer assessment.

Chart 3. Understanding the non-permanence risks of steppe ecosystems requires bespoke country level datasets such as the SPEI3 index to inform drought risks. Drought risk of the desert steppe environment increased over the past few decades and remained elevated prior to the project’s start data in 2015. Forest steppe environments follow a similar trend however, possess greater variability.

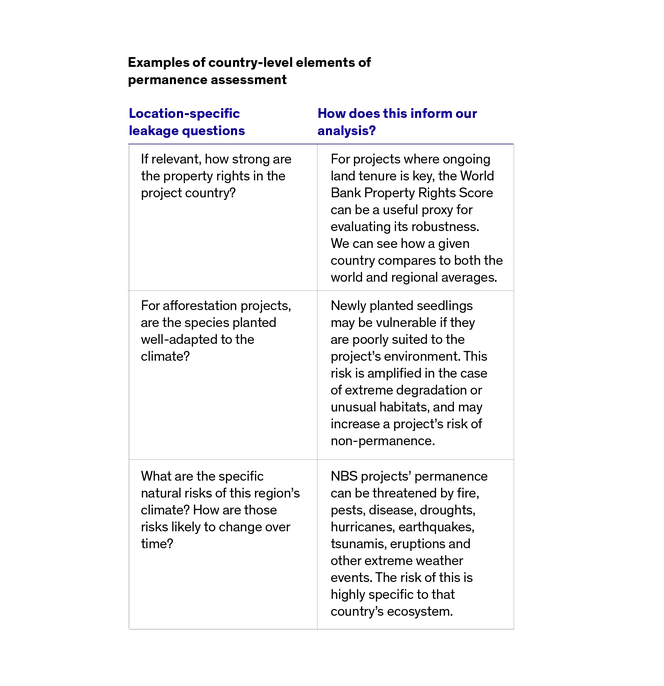

Table 4. An example of some of the key questions related to country-specific analysis of our non-permanence risk factor. Note that this list is not exhaustive.

Making sense of a project’s policy environment

Our policy risk factor evaluates the role of any relevant laws, subsidies, tax benefits and programmes that might support the project’s operation or incentivise its activities. Project ratings are bolstered by unsupportive policy environments: the less state support a project receives, the more barriers a project is likely to have to overcome.

To illustrate country-specific analysis in action in informing policy assessments, we’ll explore an example of BeZero’s bespoke national and analysis in more detail:

Policy effectiveness for methane emissions from the gas industry in Bangladesh

To inform our assessment of policy for a fugitive emissions project in Bangladesh, we evaluate policy effectiveness and coverage for the sector.

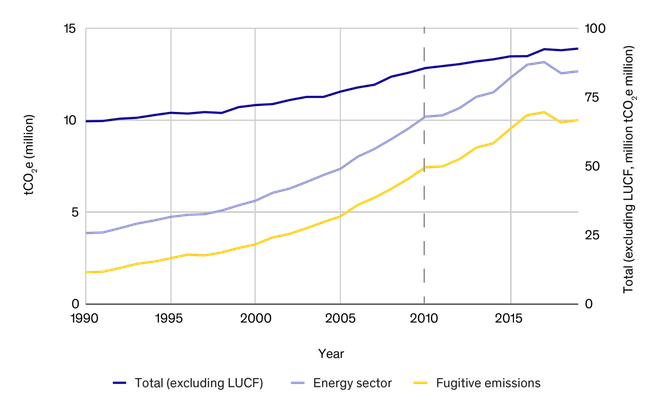

Reports of rising problems with illegal gas connections in the country suggest that the Bangladeshi government’s enforcement capability is low. The enactment of the Gas Act (2010) obligates a distributor of gas to ensure appropriate maintenance and repair of distribution pipelines. The act has not impacted fugitive emissions in Bangladesh, which continue to increase, and the rates of increase post- 2010 are not dissimilar to those for the decade prior to the Gas Act.

Bangladesh’s Nationally Determined Contributions include fugitive emissions from gas distribution systems, however, any emissions reductions within the sector are limited to conditional targets and only planned to result from external initiatives and finance.

Together, these indicate an unsupportive policy environment for activities aiming to reduce emissions from fugitive emissions.

Chart 4. BeZero incorporates national emission data to inform its policy assessments. Here, methane emissions in Bangladesh, including those from fugitive emissions, have been increasing between 1990-2019 and indicate low effectiveness of existing policies on fugitive gas emissions. For reference, the Gas Act was enacted in 2010. Data acquired from Climate Watch under a Creative Commons CC BY 4.0 licence.

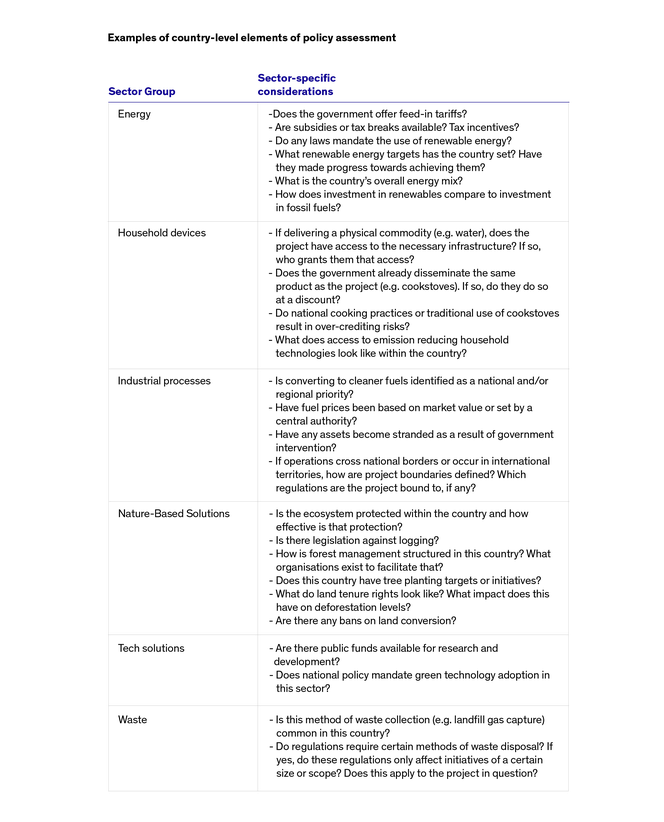

The table below shows some of the questions we might ask, relevant to each of the six major sector groups as defined by BeZero’s Carbon Sector Classification System.

Table 5. An illustrative example of the key policy-associated risks for each of BeZero’s six sector groups. Note that this list is not exhaustive.

To explore the effect of different policy environments in more detail, we can compare two forestry projects that operate in two different countries: Uruguay and Paraguay.

Numerous forestry laws in Uruguay are specifically tailored to both increasing and protecting national forest cover. In the case of afforestation and reforestation projects, a variety of programmes exist that provide financial and technical assistance to support efforts. As early as 1968, incentives were created to increase afforestation, such that forestry was the first sector in the economy to receive a promotional policy.

This first act was later revamped in 1987, with more complete policy provisions bestowed. These included tax exemptions, subsidies, and additional funding. Such policies encouraged the establishment of new plantations on ‘Forest Priority Soils’, of which over two thirds of suitable land had been designated.

Continuing the theme of afforestation advocacy, in 1998 Forestry Law 16906 was also enacted with the objective of promoting national and foreign direct investment. This policy allowed foreign investors to freely remit profits and transfer capital abroad, encouraging foreign investment in the forestry industry.

As of 2000, it was estimated the Uruguayan government had contributed more than US $400 million to the forestry industry since the passing of the initial forestry act. As a result of this support, forest area in Uruguay grew from 660,000 hectares in the 1990s to over 850,000 hectares in 2008. Furthermore, the silviculture sub-sector increased its share in the agricultural product contribution to GDP from 3.8% in 1990 to 9% in 2005.

Although many subsidies associated with these early legislations have since expired, the forestry sector still benefits from property tax relief and access to long-term loans covering up to 80% of plantation establishment costs. Moreover, as part of Uruguay’s commitment to reducing greenhouse gas emissions, they have pledged to maintain plantation levels at that of 2015 as an absolute minimum.

This evidence suggests that historical and current incentives have been successful in developing Uruguay’s forestry industry. This supports the view that projects undertaking afforestation within Uruguay have a number of initiatives from which they might draw financial and practical support, and that the broader policy environment is highly supportive of afforestation.

However, such supportive policy environments are not common in other parts of the world. In Paraguay, while several laws exist to encourage afforestation and forest protection, lack of enforcement and political support has rendered most of these programmes obsolete.

Two examples include the 1995 Afforestation and Reforestation Promotion Law and the 2006 Payment for Environmental Services (PES) scheme. While both were lauded as positive steps towards improved forestry practices in Paraguay, there was little political will to implement them. By the time the PES scheme was abandoned, millions of dollars were owed to Paraguayan farmers that they never received, leaving them in significant debt.

Paraguay also includes forest protection in its Nationally Determined Contributions (NDCs) and its proposed climate change mitigation strategies as part of the 2015 Paris Agreement, but does not discuss any specific programmes or policies in service of these aims. This creates a very different national environment to Uruguay, and improves the carbon efficacy of projects operating under these conditions, as carbon finance is likely more necessary for their operation.

Comparing Paraguay and Uruguay highlights an important part of our analytical process regarding countries and their environmental policy: that the existence of national support is not necessarily enough. For major environmental issues like deforestation and renewable energy provision, most countries have some targets in place to move towards cleaner and greener behaviour, though they may not be effective. We must evaluate the actual efficacy of these laws and their enforcement, as programmes that don’t work or are simply greenwashing make it more likely that a project is additional, and therefore deserving of carbon finance.

What if a project has no country?

In rare cases, an offset project does not operate in any one country. In such cases, our analysis expands to all the international mandates that apply to the project’s activities, followed by examining any national laws to individual jurisdictions to which the project might also be subjected. This allows us to confidently assess the project’s policy risk and assign its overall rating, even though it has no one nation associated with it.

Conclusion

Country and subnational analysis informs each our risk factor analysis for all our 270+ project ratings. The way that environmental laws and targets are - or aren't - enforced can have a bearing on various risk factors, including additionality and policy. Country analysis informs our assessments of barriers and localised threats a project might face and forms an initial structure of the research for our bottom-up, project-specific analysis. For example, the presence of national threats impacting non-permanence risks may be tempered if a project has safeguards in play to specifically counter such risks. It helps users to compare and contrast risk analysis for seemingly similar types of projects in different parts of the world.